Effects of Coronavirus on the Global Commercial Insurance Industry.

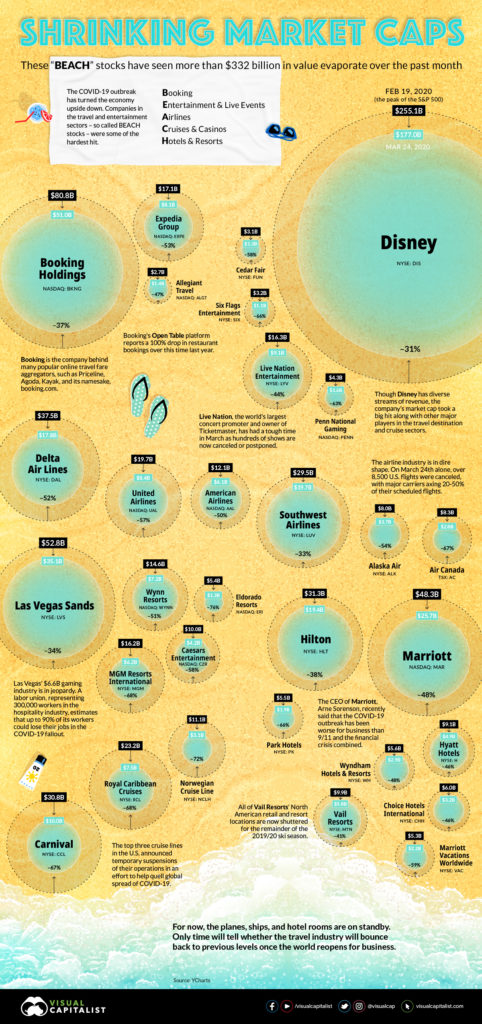

A real disastrous global event for many businesses. Below represents a small sample of typical Commercial Insurance Customers exhibiting severe financial problems across a few industries.

There’s many others such as Retail, Oil, Construction, Manufacturing … etc. All likely to be facing long term economic issues. Many companies are seeing lower revenue resulting in less cash flow, and shrinking profitability.

Business Interruption Claims Will Seriously Affect Insurers.

The Coronavirus Crisis Could Wipe Out Entire Industries.

Commercial insurance activity slowed drastically in the US during the COVID-19 lockdown, according to a report released by Ivans Insurance Services.

Across commercial lines, new policy transaction volume was down 38.9% at the end of May compared with the beginning of March, just before government-imposed lockdowns resulted in the shuttering of numerous businesses throughout the United States.

It’s a well known fact that the commercial insurance industry has always been behind the times where people, process and legacy technology and processes, slow growth and depress profit.

Is it now ready to transform the Commercial Insurance into a true Global Digital Trading Activity; using techniques learned from Finance, and the latest digital/internet technologies as the effects of Coronavirus are wide reaching and going to be very challenging?

The answer is yes. A completely new system is needed.

A complete secure digital end to end process (with no paper walls, no rekeying).

With the ability to handle the insurance process across the full value chain and allow all stakeholders (insured, brokers, insurers and reinsurers, service providers, regulators) to communicate and collaborate, interact, share/transfer digital data and information, negotiate and execute secure insurance transactions.

Much of today’s current process is “disconnected” and still handled via email, spreadsheet, phone, and lots of paper, and lots and lots of people. Bloated costs, archaic/unnecessary processes, and legacy technology are rife throughout the whole commercial insurance food chain.

But don’t despair.

We provide advanced extensible secure digital technology with streamlined end-to-end processes to provide more competitive pricing while radically improving execution time, minimizing execution costs and permitting a new breed of insurance instruments and risks all at a fair and equitable price.

It’s a platform that connects the “right people” with the “right data and information” whether they are insurance companies or their client’s risk/insurance managers/financial people; so that they are all able to work together, discuss, propose, consult, advise – 100% digitally.